Researcher Adrian Braun, has outlined in his doctoral dissertation the concept of Corporate Social Responsibility (CSR) and its applicability in the mining industry in the European Arctic. Two years later, he reflects on latest developments around sustainability reporting and the CSR concept. In this regard he discusses the emergence of the sustainable finance concept ESG - Environmental, Social and Governance (beyond the Arctic perspective).

The discourse(s) around sustainable development are dynamic and proactive behaviour by societal actors continues to be in high demand to tackle challenges of the climate crisis, plastic waste pollution in water bodies and on land, loss of biodiversity and more global problems that fit into these categories!

While each and every citizen could individually contribute with own sustainability activities in every-day life, arguably a crucial role for achieving sustainability goals (as for instance determined by the UN Sustainable Development Goals (17 UN SDGs)) plays the private sector, predominantly large-scale companies that are simultaneously large-scale polluters, and even more specifically large-scale emitters of greenhouse gases, which contradict a “stable climate”.

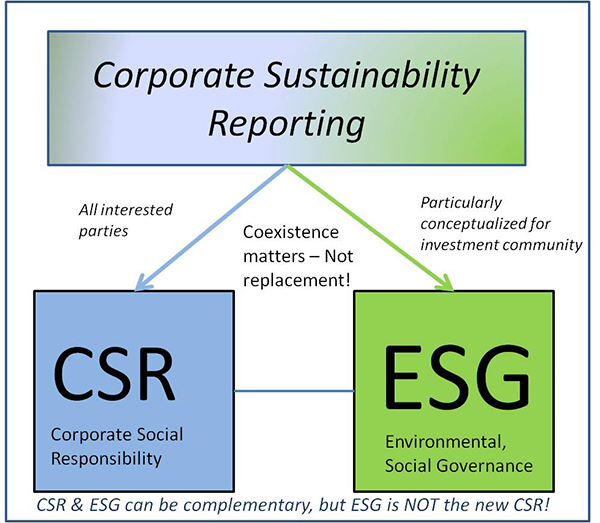

Figure: The interrelations of CSR and ESG – Both concepts should arguably persist! (Illustration - author´s own)

What has emerged in the decade of the 2000s and found wide recognition in the decade of the 2010s is the concept of Corporate Social Responsibility (CSR). This concept entails the specific understanding that companies do not have only the responsibility to be successful on the markets and generating profits for the own persistence and satisfying its shareholders, but on the top of it to address their social and ecological responsibilities highly as well! With CSR prevailing over the years of this century so far, continuously a rising number of enterprises implemented sustainability standards (e.g., ISO 26000, Global Reporting Initiative standards (GRI) and publish annually a CSR (sustainability) report.

The title indicates in a provocative way whether CSR is outdated as a concept? This rather rhetoric question emerges neither from a declining need to focus on corporate sustainability (certainly there is no decline here) nor on a reducing commitment (holistically) from the corporate sector towards sustainability actions. The issue is whether we perceive a tiredness of certain ideas and concepts and therefore possibly replace those with other concepts that seem to be “fresher” and capable to get more attention in the short-term perspective by relevant actors of the companies, particularly from potential, clients (customers) and investors.

While the notion of sustainable development remains popular, there is somewhat a weak signal that CSR as a concept is in decline and corporate publications may see a shift in either highlighting sustainability alone in this segment or introduce reference to other concepts. One of those “new” concepts that some may perceive as “fresher” is ESG – Environmental, Social and Governance and some companies made the strategic decision instead of publishing annually a CSR report, to publish the annual ESG-report.

Now there seems to be lack of awareness for some corporate publishers that CSR and ESG are not the same, although the addition of ESG in the sustainability discourses is very significant! ESG has been coined particularly to provide information for investors and funders of sustainability projects & initiatives to learn and understand the ESG impacts of a venture! Therefore, it is a term that functions first and foremost under the umbrella of sustainable finance, unlike CSR that should overall address all ecological, social and economic operational impacts to all interested parties of an enterprise.

Hence, if corporations publish their sustainability impacts, negative, as well as positive ones, then it is most likely beneficial, but a proper labelling and proper reference to the right concepts would be helpful. Having the same content labelled for instance until 2020 as CSR and from then onwards as ESG does not actually work and there might be negative rebound effects as well. Potential investors have clear expectations towards an ESG-report before investing for example into corporate (green) bonds and if the ESG content is just a “refreshed” CSR content to them, it is obvious the publishers have a lack of conceptual understanding and this might be distracting. Overall the laissez-faire commitment to certain sustainability concepts and standards may lead to blurriness and reduced impact in real-life implementation practices of those initiatives. Professionals in sustainability departments (carrying these job titles) should have the understanding and commitments to learn about the dynamic changes, as initially stated, around sustainable development, its concepts and evidently its reporting schemes. With this internal organizational understanding, companies would probably come up with the solution that both concepts, CSR and ESG, could be of relevance and not one can be easily replaced by the other.

By Adrian Braun